In the ever-changing world of cryptocurrency mining, Bitcoin halving events can significantly impact the mining landscape. As mining rewards decrease, the Bitcoin price rising can be a good news for miners.

However, given the halving of the last three bitcoins, it will take another 12 to 18 months for the price to return to a level that can offset miners’ losses. Therefore, miners who cannot accept such long-term losses may be forced out of business. In this situation, miners will have to adjust their strategies to ensure their profitability.

In this blog post, we’ll explore the key strategies for maximizing mining profits during and after halving events, covering energy optimization, hardware selection, mining pool participation, and more.

Energy Optimization

One of the most critical factors in ensuring profitability during and after Bitcoin halving events is energy optimization. As mining rewards decrease, minimizing energy consumption becomes increasingly important in maintaining a competitive edge. To achieve this, miners should focus on selecting energy-efficient hardware that offers a high hash rate while consuming less electricity.

Additionally, optimizing cooling systems to dissipate heat effectively can further reduce energy costs and extend the life of mining equipment. Miners should also consider the location of their mining operations, aiming to select regions with lower energy costs or even take advantage of surplus renewable energy sources.

By prioritizing energy optimization, miners can significantly reduce their operating expenses, allowing them to continue reaping profits even as mining rewards diminish during and after halving events.

Hardware Selection and Upgrade

In the world of cryptocurrency mining, having the right hardware can be the difference between profitability and running at a loss. During and after halving events, the importance of hardware selection and timely upgrades becomes even more critical. Start by choosing the most energy-efficient and powerful mining hardware within your budget. For example, the ASIC miner is a good choice compared to the GPU and CPU-based mining setups.

Strengths of ASIC Miner

During and after halving events, when mining profitability is a major concern, ASIC miners can provide a significant advantage. Their high processing power allows miners to solve complex mathematical problems faster and secure block rewards more efficiently. Additionally, ASIC miners consume less energy per unit of mining power compared to GPU and CPU-based mining setups, which can lead to lower operational costs.

Weakness of ASIC Miner

ASIC miners can be expensive, and their specialized nature means they may become obsolete if a cryptocurrency’s mining algorithm changes. Despite these drawbacks, investing in ASIC miners can be a smart move for miners looking to maintain or increase their profitability, particularly during periods of reduced mining rewards due to halving events.

However, all of miners should keep in mind that researching the most suitable ASIC miner for your mining operation and staying updated on the latest models is essential for maximizing mining efficiency and ensuring long-term success in the competitive world of cryptocurrency mining. Remember, investing in the right hardware is a key component to staying competitive and profitable in the ever-changing landscape of cryptocurrency mining.

Joining Mining Pools

Participating in mining pools can significantly enhance your chances of earning rewards, making it a crucial strategy for maintaining profitability during and after Bitcoin halving events. If you are interested in what a mining pool is, can read the blog “What is a Mining Pool”. By joining a mining pool, you can receive more consistent returns on your mining efforts, which can help offset the reduced rewards resulting from halving events.

Selecting the right mining pool is essential for optimizing your mining profitability. So that here list some worth considering mining pool:

- F2Pool: Founded in 2013, F2Pool is a leading global mining pool supporting various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and many more. It offers a stable mining experience, low fees, and a mobile app for convenient monitoring.

- AntPool: Owned by Bitmain, one of the largest producers of ASIC mining hardware, AntPool is a popular mining pool supporting Bitcoin, Litecoin, Ethereum, and other cryptocurrencies. It offers various features like merged mining and a user-friendly dashboard.

- BTC.com: Launched in 2016, BTC.com is a mining pool operated by Bitmain that supports Bitcoin, Ethereum, and Bitcoin Cash mining. It offers advanced technology, transparency, and an easy-to-use interface.

- ViaBTC: Founded in 2016, ViaBTC is a comprehensive mining pool supporting multiple cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and Dash. It provides various mining services, a mobile app, and a user-friendly interface.

- NanoPool: NanoPool is a popular multi-cryptocurrency mining pool supporting Ethereum, Ethereum Classic, Zcash, Monero, and other coins. It offers a stable mining experience, detailed statistics, and low fees.

- Ethermine: Ethermine is a popular Ethereum mining pool with a global presence. It offers a low 1% fee, real-time statistics, and instant payouts. It also supports Ethereum Classic mining through its sister pool, ETC Ethermine.

- Slush Pool: Established in 2010, Slush Pool is the world’s first Bitcoin mining pool. It offers a user-friendly interface, secure and transparent mining, and supports Bitcoin and Zcash mining.

Additionally, it’s essential to join a reputable mining pool with a history of transparency and fair practices, as this can help ensure that you receive your fair share of mining rewards. By carefully selecting and participating in a suitable mining pool, you can improve your mining profitability during and after Bitcoin halving events.

Diversifying Cryptocurrency Mining

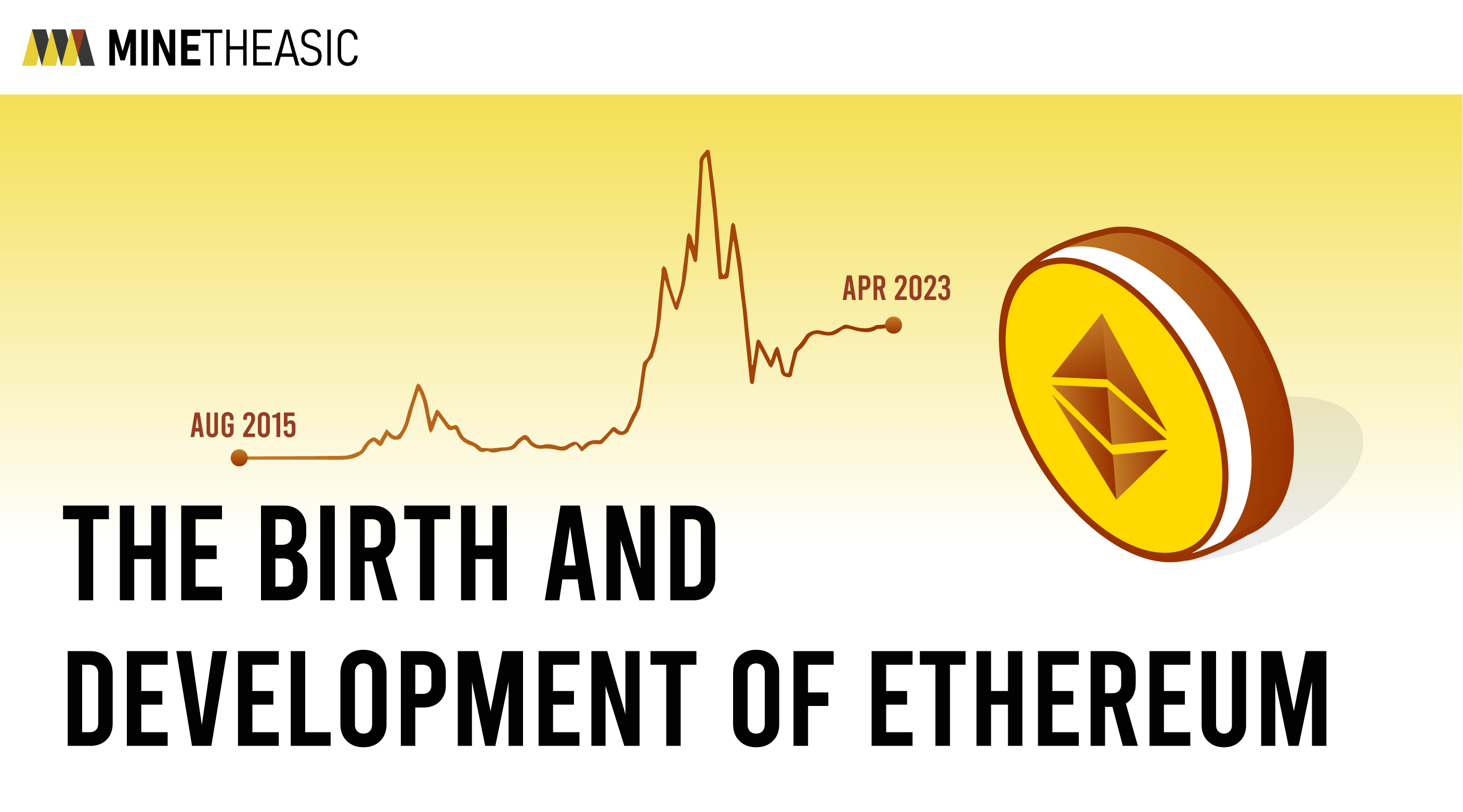

In the dynamic world of cryptocurrency mining, diversification is key to maintaining profitability, especially during and after Bitcoin halving events. By mining various cryptocurrencies in addition to Bitcoin, miners can benefit from differing mining rewards and market conditions that may offer more lucrative opportunities.

To effectively diversify, it’s essential to research and identify other promising cryptocurrencies with strong fundamentals and growth potential. Exploring alternative mining algorithms, such as Ethash for Ethereum or Scrypt for Litecoin, can help miners maximize their profits by capitalizing on the unique advantages of each algorithm.

By diversifying their mining activities, miners can better hedge against market volatility and minimize the risks associated with relying solely on Bitcoin mining, ensuring a more stable and profitable mining operation in the long run.

Monitoring Market Trends and Adapting Strategies

In the dynamic world of cryptocurrency mining, staying informed about market trends and adapting your mining strategies accordingly is crucial to maintain profitability.

Miners should keep a close eye on factors such as network difficulty, mining rewards, and cryptocurrency prices, which can significantly impact the potential returns from mining activities. By monitoring these trends, miners can make data-driven decisions on when to adjust their mining operations, such as switching to mining other cryptocurrencies or upgrading their hardware for increased efficiency

Additionally, staying informed about industry news and technological advancements can help miners identify new opportunities and stay ahead of the competition. By continuously refining their mining strategies based on up-to-date information, miners can optimize their operations and ensure long-term success in the ever-evolving landscape of cryptocurrency mining.

Exploring Alternative consensus mechanisms

In the dynamic world of cryptocurrency mining, it’s crucial to keep an open mind and explore alternative consensus mechanisms that can offer new opportunities for profitability.

In the dynamic world of cryptocurrency mining, it’s crucial to keep an open mind and explore alternative consensus mechanisms that can offer new opportunities for profitability.This approach tends to be more energy-efficient and can provide a more consistent income stream for miners, as rewards are distributed proportionally to the amount staked.

By investing in and supporting cryptocurrencies that utilize PoS or other innovative consensus mechanisms, miners can diversify their income streams and mitigate the risks associated with halving events in PoW-based cryptocurrencies. This forward-thinking strategy can help miners stay ahead of the curve and maintain profitability in an ever-changing market.