The rapid development of blockchain technology and the trend of the virtual currency market have led more and more people to pay attention to the field of mining. Ethereum (Ethereum) is one of the most popular and widely used virtual currencies.However, in the process of mining, many people don’t know the origin of ASIC mining machine mining, as well as some content about Asic that you don’t know and potential opportunities and crises. Here, I will explore the past and present of Asic with you.

ASIC is a natural evolution. The earliest design was to use CPU mining. Later, some people tried other chips, experienced FPGA, GPU, and finally ASIC chips appeared. Everything is market behavior: some people try, profit, and then step by step Something unexpected emerges.

The development process of mining chips has probably gone through such a process: CPU, GPU, FPGA and ASIC.

1. In the era of CPU mining, when Bitcoin first appeared, it was mined with CPU, but CPU is mainly good at general computing, and this mining method was quickly eliminated;

2. In order to improve mining efficiency, miners began to use graphics processing units (GPUs) for mining. The two major manufacturers of GPU chips are Nvidia and AMD, and Nvidia has made a lot of money;

3. As the value of Bitcoin continues to rise, miners need faster and more efficient mining equipment. Miners start to use FPGA for mining. FPGA can be programmed to achieve more efficient hash calculation than GPU;

4. Then use ASIC to mine. ASIC is a chip customized for a specific algorithm, which can complete hash calculation faster and is more energy-efficient than FPGA. Up to now, the current mainstream method in the industry is to use GPU and ASIC for mining.

The emergence of ASIC, for the currency of the PoW mining algorithm, is actually an inevitable evolution to a certain degree of prosperity and ecology. Driven by interests, when the fixed cost of developing custom chips is low enough compared to the future, chip design ASICs will appear if the operator improves the efficiency of the mining algorithm by customizing the mining algorithm.

The Era of GPU Obsolete

In the early days, before 2016, because GPU mining machines were more affordable and versatile, they were used in other different computing processes. And it has the value of secondary recycling, and it was once sought after by many absenteeism, but the defects of GPU are also very obvious.

The graphics card problem.

As long as you have been mining, you will know that the more load for mining is not on the GPU core, but on the video memory. When mining, the GPU core has almost no load, while the video memory is running under high-intensity overload. The damage to most graphics cards is not because the core is broken, but because things like video memory or power supply are broken.If it is in an uninterrupted overload state every day (that is, overclocking), the life of the graphics card will be directly folded in half.

Since all the people who use GPU to mine are individuals, no matter at home or at school, I have to hold a large fan and blow on the graphics card to keep the video memory within 90°C, which is relatively safe.But for the vast majority of graphics cards designed for games, high-intensity video memory work is not within the scope of thermal design considerations. There are many cards with no cooling measures for video memory, and there are not a few of them.

Cooling problem.

Graphics cards generally mine eth and consume video memory when they are loaded. Therefore, the overclocking solution for mining is generally to limit power consumption, reduce GPU frequency and then increase video memory frequency. Especially for 3070, there is no brand that covers the video memory radiator. The pressure is actually quite high.

In the case of normal maintenance of mining income, the computer is basically running at 100% full load, and the temperature of the graphics card is generally relatively high, which can reach more than 90 degrees in severe cases. The damage to electronic components is still quite large. If the quality is not good enough, it is easy to burn. element.

In addition, due to the poor heat dissipation of the computer itself, many people will modify the heat dissipation and install fans, etc., which is also an expense.

High electricity bills.

For the vast majority of urban areas, the high electricity bills have also discouraged miners. Since the prohibition of graphics card mining on Ethereum, a large number of second-hand graphics cards that have been used for mining have flowed into the graphics card market. mess. In 2022, China issued a ban on graphics card mining, which further created the stage for GPU mining.

The Birth and Development of ASIC

ASIC (Application Specific Integrated Circuit) is an integrated circuit designed for a specific application field, and its design purpose is to perform a specific function, rather than a general calculation process. ASIC mining machine is a hardware device specially designed for mining, which can be used for fast calculation and mining of virtual currency. ASIC mining machines use ASIC chips for calculations, and the calculation efficiency is high. The built-in chips of the mining machines can only be used for mining calculations of specific virtual currencies, such as Ethereum.

The ASIC mining machine is specially designed for mining. It is not only optimized for the mining algorithm, but also more convenient in terms of operation and maintenance and deployment than general-purpose chips such as GPU. The quality requirement will also be lower than that of the GPU.

Advantages of ASIC mining machine

Efficiency.

ASIC mining machines are customized and optimized for specific algorithms, with more efficient computing power and the ability to quickly complete the mining process. The GPU mining machine needs to mine through the graphics card on the computer, and its computing power is lower than that of the ASIC mining machine.

Low energy consumption.

The power consumption of the ASIC mining machine is relatively small among mining equipment, which can effectively reduce energy consumption and return more income. In addition, the production line of ASIC mining machines can be highly customized after manufacture, so the energy consumption is lower than that of traditional mining methods.

higher life cycle.

Since ASIC mining machines are designed for specific algorithms, they are more durable than GPU mining machines, and durability is also an advantage of ASIC mining machines. They have long-term optimized algorithms and designs, so Ethereum ASICs will have a longer lifespan and more benefits. In addition, ASIC mining machines have advantages against general mining equipment, which may lead to higher returns.

Disadvantages of ASIC miners

expensive purchase cost.

The design and production of ASIC mining machines are very expensive, and their specifications are related to the algorithm of virtual currency, so the cost of purchasing ASIC mining machines is also high. In addition, the ASIC mining machine is not universal, which means that it can only mine one currency after purchase, so it is not recommended to buy it. If you have a mining cluster like the Ethereum mining pool, you can spend this to upgrade the entire cluster immediately, and In the case of multiple mining pools, miners only have the ability to switch the number of mines between clusters.

easily outdated

Since the ASIC mining machine is specially designed for a specific algorithm, if there is any change in the algorithm of Ethereum or other virtual currencies, the computing power of the ASIC mining machine will become obsolete and need to be repurchased for upgrading. Therefore, compared to GPU mining Machine, easy to become obsolete has become a disadvantage of ASIC.

As a miner, what do you think of ASIC machines?

“When I got the first bitcoin, I would say, this is the first time I really own an asset that is completely mine, without borders” I believe that it is precisely because of such a decentralized purpose that ASIC can rise so rapidly in a short period of time and replace GPU as the mainstay of the current mining machine industry.

In the currency circle, there is a very interesting term for the group that uses ASICs for mining, called the “Guardians”. In fact, it lies in the loyalty of miners of ASIC mining machines to the currency. We can explain it from two perspectives:

For mining machine manufacturers: the fixed cost of the initial R&D investment and the investment in future mining machine production, including the entire mining machine production and sales supply chain, are very high sunk costs.

For miners who buy chips: ASIC chips are chips customized for a specific mining algorithm, not as good as GPU chips, and they can resell second-hand chips to recover part of the cost.

The vast majority of opinions believe that the core of ASIC is still decentralization, but decentralization does not mean absolute average, and it is inevitable for a small number of people to hold some rights in the eyes of others. And from the perspective of efficiency and market regulation, such a situation will definitely occur.

“Blockchain is a tool that helps achieve fairness in process, not in outcome.” from article “PoWs vs. PoS”

When I owned the first bitcoin, I would say, this is the first time I really own assets that are completely mine and borderless. We call this “resistance to censorship,” and resistance to censorship is feature, what does it bring us? I think it is a right of freedom. If there is no such right, then at some point someone may tell me that your account is frozen, or that I will encounter some kind of currency control system.

And, the stability of the rules, instead of encountering a certain power that says that the rules will be changed today, and then everything changes. I still remember Fu Sheng, the CEO of Cheetah, complained helplessly about the huge impact of changes in Google’s advertising algorithm on their business revenue.

Therefore, decentralization will always be the key to the development of ASIC and the scale it has today to replace GPU and become the real king of mining machines.

It is worth mentioning that among the main players in the ASIC chip market, Chinese manufacturers are particularly prominent. The main cryptocurrency ASIC chip suppliers include Bitmain, MicroBT, Canaan Technology, Ebang International, and 90% of the world’s Bitcoin Mining machines are also produced by these manufacturers. Among them, Bitmain alone holds 70% of the computing power of the global bitcoin mining pool. As early as 2018, when the first bitcoin surge peaked, Bitmain had booked 30,000 pieces of 7nm production capacity of TSMC, which was almost 300 million U.S. dollars , for a time the limelight was the same. Mining machine ASIC chips have a high demand for technology. Several major ASIC chip manufacturers are more aggressive in technology. The lower the technology, the higher the cost. For example, in 2022, MicroBT’s 3nm chips will also be paid out through the supply chain, Liyang testing, Samsung foundry; it is reported that Ebang International is also developing proprietary 5nm ASIC chips.

Under the same computing power, although the number of GPU chips used is less than that of ASIC chips, the flexible use of ASIC chips and very competitive prices make it impossible for graphics card mining machines to compete. This is the product of human beings using science and technology to continuously strive for maximum benefit.

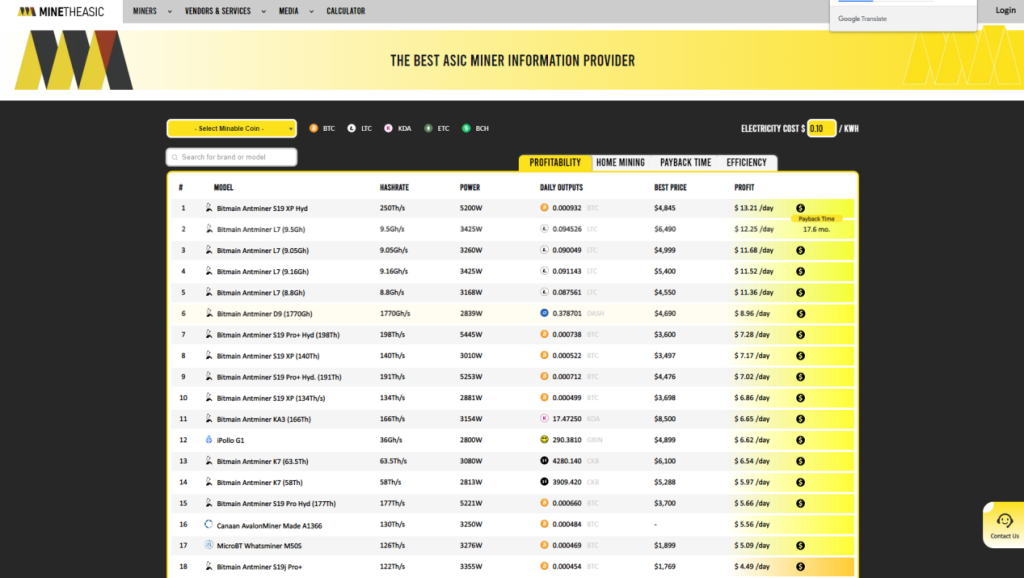

At present, well-known machines and manufacturers in the ASIC industry can refer to this website: Minetheasic , which lists in detail the most profitable and popular chip mining machines among the current ASIC chip mining machines, representing ASIC machines used by most miners today.

However, the current ASIC mining machines are putting more and more pressure on the environment and electricity. Many countries and regions, such as China, have restricted virtual currency mining in 2021, and a large number of mines have been transferred to North America. However, it is not difficult to see that the views of various countries’ policies on virtual currencies are quietly changing. It is unknown whether the prosperity of mining machine chips has passed.

At the same time, there are several reasons why mining machine chips are no longer favored: First, as cryptocurrencies become mature and stable, coupled with policy restrictions, hardware technology needs to be continuously upgraded, etc., it is becoming more and more difficult to mine coins ; secondly, the volatility and instability of the cryptocurrency market, the mining industry has become more and more unreliable, so that people are no longer as keen on buying mining machine chips as they used to be; third, mining digital currency requires a lot of electricity and Computing power has had a non-negligible impact on the environment. A 2021 report shows that Bitcoin consumes 91 terawatts of electricity every year, placing a heavy burden on the environment.

One word, miners should also be soberly aware that ASIC is not the key point. Compared with ASIC mining, it is more efficient, lower cost, and more power-saving mining method. I don’t know, is ASIC the ceiling? I don’t know if there will be more powerful and faster mining machines in the future, biological mining machines, quantum mining machines…? No one knows, but the currency circle and mining machines are developing continuously. Only by being able to stand on the cusp of development and look at problems and situations can we make better use of the current environment to create more valuable benefits for ourselves.

At last, as an absentee, if you want to get a piece of the big wave of participation in decentralization, you need to make a plan in advance, have extraordinary keen observation skills, and know which currency is worth investing in at the moment in the market, and where the electricity bill is. It is relatively cheap, the price budget of the chip mining machine and whether it can be paid back in time. If you can still invest in this industry after understanding the advantages and disadvantages of ASIC, then congratulations on becoming a senior miner and making your due contribution to demonetization.